Music has always evolved with technology, and MP3 downloaders have played a key role in this shift. These tools have transformed the way listener’s access, enjoy, and share their favorite songs. Instead of relying on physical media or streaming services with internet limitations, MP3 downloaders offer a direct and reliable method to store music offline. Whether you are traveling, working out, or relaxing at home, you can listen without interruptions. The control is entirely in the listener’s hands, reshaping how people experience music every day.

What Makes MP3 Downloaders So Effective?

MP3 downloaders stand out because of their simplicity and flexibility. You no longer have to worry about unstable connections or subscription fees. With a few clicks, Most popular songs users can save songs permanently on their devices.

Key Advantages Include:

- Offline Listening – Enjoy music anytime, anywhere without data usage.

- Better Control – Create custom playlists without platform restrictions.

- No Ads – Say goodbye to mid-song advertisements and buffering.

- Storage-Friendly – MP3 files are lightweight and easy to organize.

These features make MP3 downloaders ideal for those who value quality and convenience.

A Personalized Music Experience

One of the biggest changes MP3 downloaders bring is personalization. Listeners can download only what they love, instead of browsing through unwanted recommendations or algorithm-driven lists. This makes each playlist unique and tailored to individual taste.

With MP3 Downloaders, You Can:

- Save rare or older tracks that may not be available on streaming apps.

- Convert music from videos or live sessions to audio files.

- Access global music without regional limits or licensing barriers.

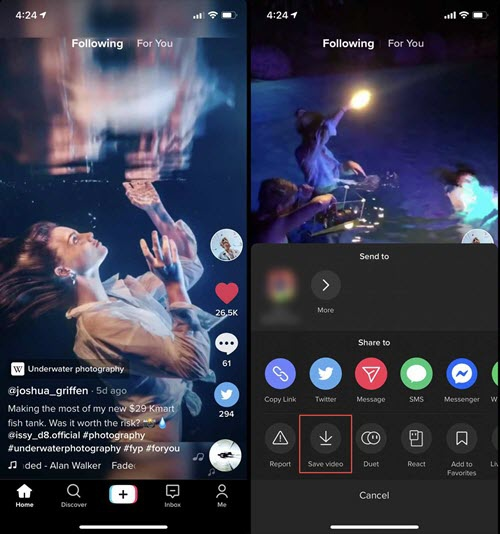

Accessibility and Ease of Use

MP3 downloaders are designed to be user-friendly. Even beginners can learn how to download songs within minutes. Whether on a phone, tablet, or computer, the process is simple and secure.

Popular Uses Include:

- Downloading workout mixes for the gym.

- Saving soothing tunes for offline meditation.

- Creating soundtracks for road trips or flights.

How they are changing the Music Landscape

MP3 downloaders empower listeners rather than locking them into apps or platforms. This freedom is changing how music is consumed, owned, and shared. Artists also benefit, as more tools allow for direct music distribution, bypassing traditional gatekeepers. MP3 downloaders are not just tools they are reshaping musical habits. By giving users complete control over their music collections, these downloaders make listening more enjoyable, flexible, and personal. They are breaking barriers and helping music reach more people in more ways than ever before.

Summary of Key Points:

- MP3 downloaders allow offline listening without ads or restrictions.

- They offer easy downloading, simple file management, and global access.

- Personalized playlists and rare song access improve the user experience.

- They contribute to a more open and independent music ecosystem.

MP3 downloaders are changing the way we hear music and listeners everywhere are loving the difference.